Trading Candlestick Formations

By far in binary options trading, candlestick formations are regarded as the most effective ways to carry out the technical analysis. To give you an insight into the swings of price action in the market, these candlesticks are used by the experts. It actually represents the instincts related to the price action of a particular trading entity and how it can affect the overall pricing. Its use helps one to determine the current strength and direction of the trend enabling him to frame his strategy accordingly.

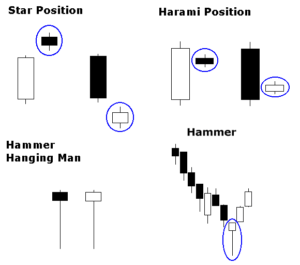

The price action, thus measured, is shown in the numerous candlestick patterns while not altering its basic format. If you are a novice, then it may be quite difficult for you to get the useful information as you will have no idea what data has to be used. For that, you have to know very well what candlesticks are and how can you use its functionality to the optimum. Candlestick is an effective unit to see the various changes that the price of a certain trading entity undergoes during a specific period. In a close rectangular-shaped box, the price action is represented. The pattern is comprised of opening, highs and lows, which is ultimately followed by closing.

You should also consider the backdrop colour of the box. An empty and white-coloured box stands for a bullish session which means that the trade is closed with a price higher than the opening price. On the other hand, a bearish session is represented by a black-coloured box and short horizontal lines. A session is said to be bearish when the closing price is almost same as that of the opening price.

Advantages of Using Candlestick Formations

- Market Turns can be Predicted: As compared to traditional indicators, candlestick charts facilitates the investors to predict the market turns more effectively. As such, he can hit the market whenever he wants.

- Deep Insights to Forex Market Condition: Unlike the traditional bar charts, candlestick patterns also enable the investor to know the underlying force that is causing the move.

- Improves Analysis of Western Charts: If you wish, then you can also use western technical tools on candlestick patterns. By combining the Eastern and Western analysis in this way, you will be able to perform better in the trading than a person who uses only the bar charts.

- Can be Understood Easily: Anyone, from an experienced trader to a novice, can derive immense benefits by using these patterns as they are easy to understand.

TIP: Three White Soldiers and Three Black Crows Trading Strategy

Normally, the Three Black Crows Pattern in an uptrend signals the bearish reversal of the trend. And, in a downtrend, it signals the continuation of the trend in the same direction. In this way, the traders are able to identify …

Normally, the Three Black Crows Pattern in an uptrend signals the bearish reversal of the trend. And, in a downtrend, it signals the continuation of the trend in the same direction. In this way, the traders are able to identify …

Undoubtedly, these patterns play an indomitable role in revealing myth and riskiness associated with the market of Forex trading. As such, the novice traders gain self-confidence to go on trading on the entities they like. After all, the clarity and the accuracy level that these formations have given to the enthusiasts are far beyond comparison.

Recommended broker for this strategy

| Broker |

)

)

Sir will u teach me candlestick analysis using binary options without indicators

Please can you send me more some of these strategies