Martingale: Effective Money Management System or Not?

Astonishingly, trading and gambling can be identified as the two wheels of a cart as they share many things in common. Principles that were popular in casinos are now applied for designing trading strategies. Interestingly, the Martingale principle is a prominent instance of such connection. In the past, gambling enthusiasts would win huge rewards by implementing this principle. The principle was often used in roulette or blackjack, on the other hand, it can not be used in slot machines.

Well, then when it comes to trading with real money and not gambling, this can be a risky strategy, bringing substantial loss. However, on striking the right notes a trader can save himself from financial damages. Read on to know more about Martingale binary option strategy.

A Brief Reviewof Martingale for Binary Options

Initially known as Doubling Down, the Martingale principle was first designed by Paul Pierre Levy, a popular French Mathematician. The principle has its basis in the first bet. According to which, if the present rate makes for loss, then that should be doubled as the next profitable rate is likely to cover the loss as well as bring profit. To cite an example, you think of the heads and tails game, where you will require setting an initial rate, say 1 Euro. No matter in which side the coin drops, the chance is 50:50. Since this system has failed to give a winning chance, the casinos have taken to the second green field.

Coming back to the binary options trading, those who have a huge initial capital have the chance of neutralizing losses as well as increasing their profits. And the core principle here remains to derive income from the system through a single profitable transaction.

The Martingale strategy has been used by so many financial market traders, particularly by Forex investors. Not only that, binary options are linked to Martingale strategy to get ample benefits.

Trading Binary Options with Martingale

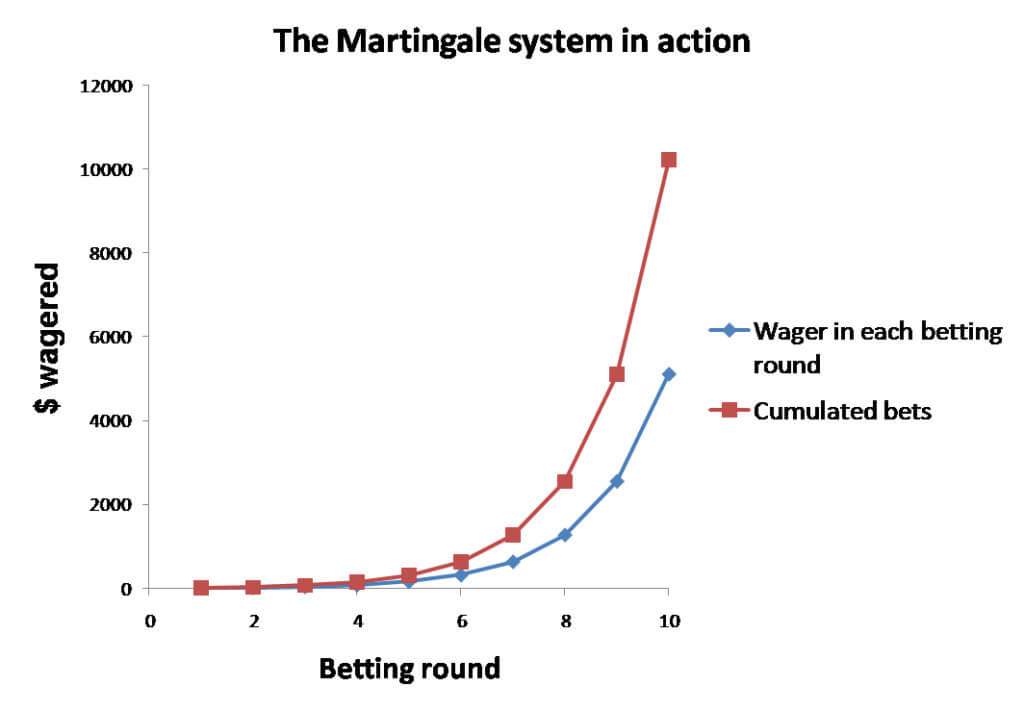

To begin with, the trader should consider the previous bets as according to the strategy and it is the sum total that should be doubled. Suppose you purchase a binary asset for $20 and then you couldn’t make profit. Therefore, the next bet is likely to be $40. However, if you again prove to be unlucky, then the asset you buy would cost $60. In case it doesn’t bring profit, the amount invested should be around $120. Well, this process continues till you receive a lucky bet and secure sufficient money to recover the losses.

This strategy can turn out to be an efficient way of addressing the losses and deriving profits. Even then, a huge amount of risk is associated as the capital is completely exposed. The trader therefore needs to ensure a considerable amount of initial deposit. More information on this topic can be found here:

)

)

Must-read blogs

If your auto trading system offers a Martingale money management, make sure to deselect it. If you are trading manually, do not use a Martingale money management system either.

Thanks for your comment bob, I think that it’s not too bad to use it, if you use it wisely. I’d never go more than 2 rounds of martingale

It makes sense to use maybe 1 or 2 levels of martingale, but more than that, it just wipes your account clean. Be careful traders

That’s very true. Look at the picture above, it shows how it exponentially grows.